Services for customers

We understand that everybody can need a little extra help from time to time. Our teams are here to offer you the support you need when you need it most.

You may also be interested to know more about some of our additional services which can help to make life a little easier for you and your loved ones.

Money advice

Struggling to cope with your bills? Don't fully understand what benefits you're entitled to? You can get in touch with us for rent arrears problems, benefits advice and debt counselling. You can also visit our Money advice page for money saving and budgeting tools and tips.

Services for customers

Anti-social behaviour

We are committed to keeping our communities safe for all of our customers. We aim to reduce anti-social behaviour on our estates by investigating anti-social behaviour (ASB) and breaches of tenancy. Visit our anti social behaviour page to find out how to report ASB and what we can do to help.

Help finding a job

Looking for help finding a new job or a change of career? We offer free specialist support for customers who are searching for their next job. This includes keeping you up to date on job and training opportunities with YHN and partner organisations in Newcastle.

Extra support to manage your tenancy

We can provide practical support and advice for anyone who needs some extra help to find housing and manage their tenancy. We want to help you stay in your tenancy, access the right accommodation for you, set up and run your home well and help you to stay safe and have good health and wellbeing.

Worried about someone?

If you believe that a friend, family member or neighbour is experiencing abuse or neglect at home then you can report it to us confidentially. To find out how you can report your concerns to us and for more information about the help that we can provide to customers, click the link below.

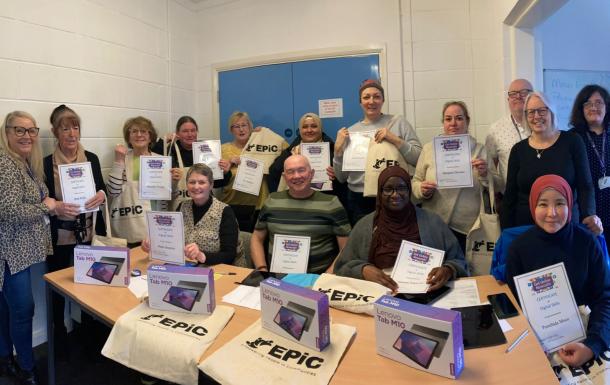

Digital skills

Get Online Newcastle is a partnership between Newcastle City Council and Your Homes Newcastle. We are committed to supporting people to get online and equipping them with valuable digital skills through providing a variety of training programmes and in-person support.

Additional services

Garden Care

Keeping you garden tidy and clear of waste is part of your tenancy agreement.

Our Garden Care team can take care of this for you for a small weekly fee.

Save energy

We can provide bespoke energy saving advice for you and your family.

Our trained officers are available to assess your home to help you to save energy.

Furniture services

Are you getting settled into a new home or looking to upgrade your old goods?

Our furniture services offer high-quality flexible and affordable furniture options.